Introduction

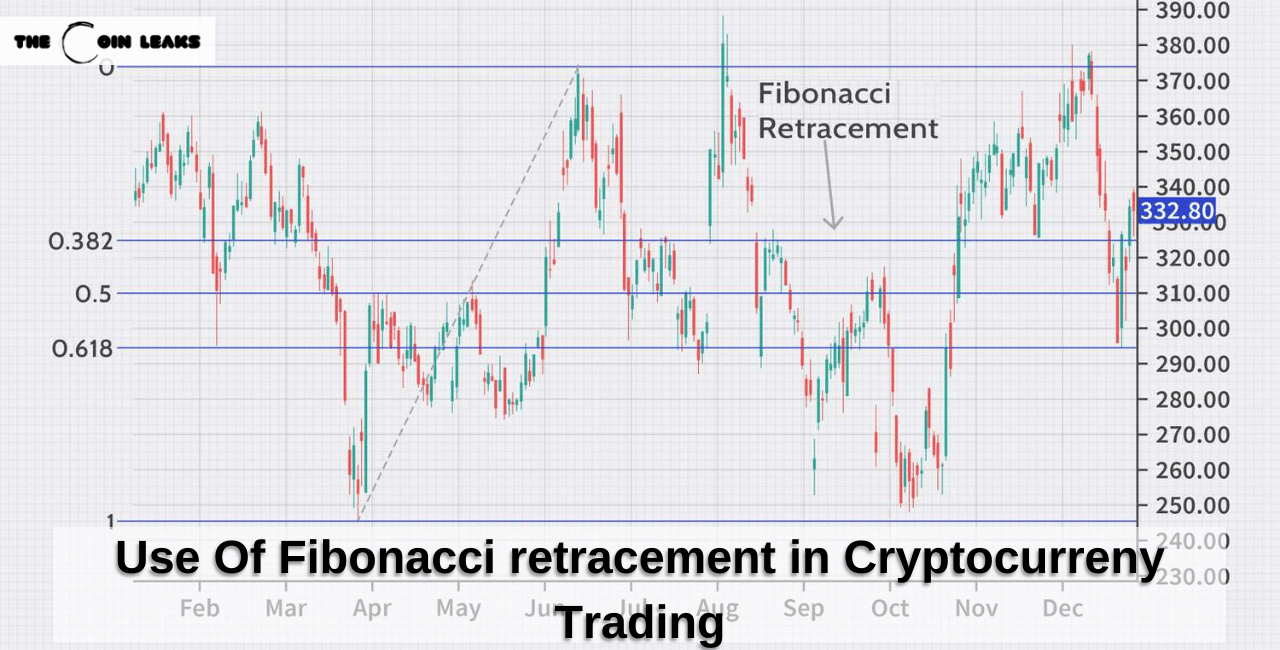

Fibonacci retracement is a technical analysis tool that uses horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the price continues to move in the original direction. These levels are derived from the Fibonacci sequence and are commonly used in conjunction with trend lines to find entry and exit points in the market.

The Fibonacci sequence, discovered by the Italian mathematician Leonardo Fibonacci, is a series of numbers in which each number is the sum of the two preceding ones, usually starting with 0 and 1. The key Fibonacci levels for retracement are 23.6%, 38.2%, 50%, 61.8%, and 100%. These levels are derived from the mathematical relationships between the numbers in the Fibonacci sequence.

Uses of Fibonacci retracement Cryptocurrency Trading

In cryptocurrency trading, Fibonacci retracement can be used to identify potential levels of support and resistance, helping traders to make informed decisions about when to enter or exit a trade. For example, if the price of a cryptocurrency is trending upward, a trader may use Fibonacci retracement levels to identify potential areas where the price may pull back before continuing to rise. By placing a buy order at or near these levels, the trader can potentially enter the market at a lower price and reap a greater profit when the price rises. Similarly, if the price is trending downward, a trader may use Fibonacci retracement levels to identify potential areas where the price may rebound before continuing to fall. By placing a sell order at or near these levels, the trader can potentially exit the market at a higher price and minimize losses.

Fibonacci retracement can also be used in conjunction with other technical analysis tools such as trend lines, candlestick patterns, and moving averages to provide a more comprehensive analysis of the market. For example, if a trend line and a Fibonacci retracement level are both indicating a potential area of support or resistance, the trader can have more confidence in their decision to enter or exit the trade.

It is important to note that Fibonacci retracement is not a standalone indicator and should be used in conjunction with other forms of analysis such as fundamental analysis, news and global events etc. Also, it is important to remember that Fibonacci retracement levels are not guarantee to work all the time, as the crypto market is highly volatile and can be affected by many factors. Therefore, it is important to use proper risk management techniques and to keep in mind that past performance is not necessarily indicative of future results.

Final Note

In conclusion, Fibonacci retracement is a valuable tool for crypto currency traders, as it can help them identify potential levels of support and resistance and make informed decisions about when to enter or exit the market. By using it in conjunction with other technical analysis tools and keeping in mind the inherent volatility of the crypto market, traders can potentially increase their chances of success. However, it’s important to remember that Fibonacci retracement is only one aspect of an overall trading strategy and should not be solely relied upon.